Moving Your Journey Forward

Whether you're dreaming of a new home for your growing family or planning an exciting road trip to a new destination, we're here to keep you moving forward.

Join now and open an account with just $5!

No matter where life's adventures take you, we've got you covered with low fees, better rates and on-the-go digital banking tools.

Who Can Join?

Membership is open to anyone who lives, works, worships or attends school in one of the 75 counties we serve.

Businesses and other legal entities located in these counties and anyone who is an immediate family member of a current member is also eligible for membership.

Never once in all my years of doing business with Gulf Winds have I felt like a customer. From the very first day, they made me feel like family and that is priceless. I'm guessing that I recommend Gulf Winds at least once a day.Michael H.

Ready to Open an Account?

Higher savings rates, better loan rates and lower fees. We believe banking should move you forward. Your future self will thank you.

Frequently Asked Questions

Typically, the account application process takes just a few minutes if you have all the required information ready. After you submit your application, we may need up to two business days to verify your information and complete the process.

To open a new account, you'll need a government-issued ID (such as a driver's license or passport), your Social Security number, and proof of address (such as a utility bill or lease agreement). Additionally, if you're opening a joint account, both parties will need to provide this information. In some situations, we may need additional documentation to complete your application.

You can fund your new account using a debit or credit card, by transferring money from an external account, by depositing cash or a check at one of our branches, or by initiating a wire transfer. Mobile check deposit funding is available after membership has been established.

Gulf Winds will utilize microdeposits to verify your new account funds if using electronic transfer. Microdeposits are a secure and convenient way for us to verify your external account ownership during the account opening process. By confirming these small deposits, we ensure the safety of your financial information and streamline your onboarding experience with Gulf Winds Credit Union.

You will receive further instructions on how to complete this verification process following application submission.

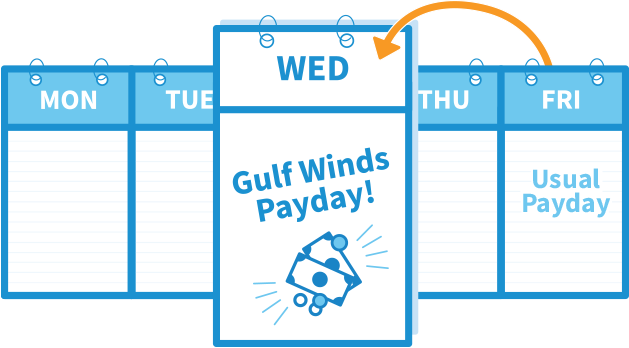

** Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.